Post-merger Integration: ERP Strategies

Combining two businesses following a merger or acquisition is a major challenge. The trick to delivering added value for the combined entity lies in the post-merger integration activities. This requires clear thinking and a defined strategy around how business systems should support the integrated business.

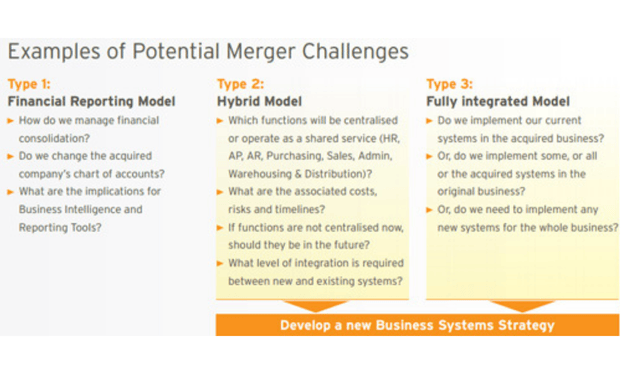

Mergers come in all shapes and sizes, but typically can be characterised as one of the following types:

Type 1: Financial Reporting Model

The acquired business continues to operate separately, reporting financial results to the parent.

Type 2: Hybrid Model

The acquired business continues to operate separately, but some functions are merged or operate on a Shared Services basis.

Type 3: Fully Integrated Model

Both entities are fully merged into a new combined entity.

Decisions regarding the proposed combined operating structure are generally made in the boardroom well in advance of closing the deal. A decision to adopt the Financial Reporting model, with each part of the business continuing to operate separately, will have the least impact on business systems. In contrast, a full merger of two separate entities into a new combined entity, or a hybrid model where some elements of the newly acquired business remain the same while others are merged, can be very challenging propositions from a business systems perspective. Post-merger integration activities, rightly considered fundamental to the success of the merger, can be guaranteed to have a huge impact on the business systems landscape. Planning for a successful merger must consider the business systems strategy for the combined entity, as mismanagement of this aspect of the post-merger integration is likely to result in a poorer outcome.

One of the first steps in ensuring a successful post-merger integration is to establish a business systems strategy for the combined business that supports the corporate vision and objectives. The goal should be to provide clarity in relation to business objectives and how the systems strategy supports those objectives.

There can be a number of realistic strategic options and establishing which one is best depends on a variety of factors, such as cost, timelines, future plans and where you’re starting from. Thorough analysis of each of the various options is then required to devise a coherent plan of action.

This blog is an extract from Issue 1 of the Lumenia Executive Briefing “Business Systems Strategy following Merger or Acquisition”, aimed at senior executives who have an interest in matters relating to the effective management of IT. This Briefing:

-

Classifies Mergers and Acquisitions and identifies when a new business systems strategy will be required.

-

Describes some of the steps required to develop a business systems strategy in this context.

-

Provides a detailed checklist of IT-related issues that may have to be addressed in the short to medium term.

-

Identifies the IT challenges involved in realising some typical business benefits that might be expected following M&A activity.

These Briefings are available to download at: http://www.lumeniaconsulting.com/resources/executive-briefings

This Blog was written by John Donagher, Managing Partner at Lumenia. If you would like further information on ERP Strategy following Merger or Acquisition or on any other aspect of ERP please send an e-mail to John Donagher.